online trading has become an increasingly popular way for individuals to grow their wealth. While the market holds significant profit potential, it can be equally challenging without the right strategies in place. One of the most effective methods for optimizing returns is technical analysis. This trading tool allows investors to interpret price patterns, predict market trends, and ultimately make more informed decisions.

What Is Technical Analysis?

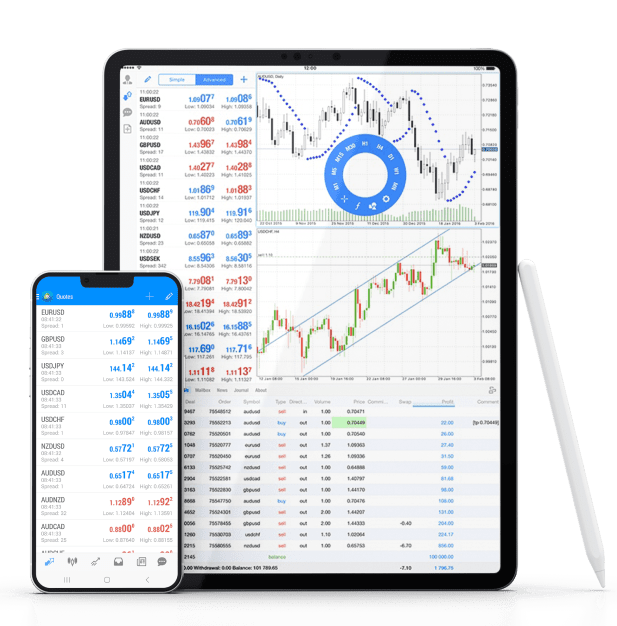

Technical analysis is the study of past market data, primarily price and volume, to forecast future price movements. Unlike fundamental analysis, which focuses on business performance or economic factors, technical analysis zeroes in on charts and graphs to identify trends and trading opportunities.

Traders rely on key indicators such as moving averages, relative strength index (RSI), and candlestick patterns to gauge market sentiment. By understanding these elements, traders can decide the best times to enter or exit a trade, and in doing so, maximize potential profits while minimizing risks.

Essential Technical Analysis Strategies

1. Identify Trends

The foundation of technical analysis is trend identification. Markets move in three directions—uptrend, downtrend, or sideways. Traders use tools like moving averages and trendlines to detect these patterns and ride the momentum. For example, when prices consistently chart higher highs and higher lows, it’s a clear indication of an uptrend.

2. Support and Resistance Levels

Support and resistance levels are crucial for maximizing trading opportunities. Support refers to price levels where a stock or asset tends to find buying interest, preventing the price from falling further. Resistance, on the other hand, marks the point where selling pressure stops the price from rising further. Identifying these levels helps pinpoint potential entry and exit points.

3. Utilize Indicators Effectively

Indicators like RSI and MACD (Moving Average Convergence Divergence) provide insights into market momentum and potential reversals. For example, an RSI value above 70 typically signals an overbought condition, suggesting a market correction might be due.

4. Candlestick Patterns for Precision

Candlestick patterns, such as the hammer, doji, or engulfing patterns, offer clues about market sentiment. These patterns reflect a battle between buyers and sellers, providing early warnings for potential trend reversals or continuations.

Why Technical Analysis Matters

Technical analysis empowers traders to make calculated decisions rather than emotional ones. By using historical data, traders gain the ability to evaluate potential risks and rewards, increasing the probability of success in volatile markets.

However, it’s important to note that while technical analysis is an effective tool, no strategy is foolproof. Combining it with proper risk management techniques and diversified trading plans can help mitigate losses and increase long-term profitability.